Bob Iger stepped down as CEO of Disney last week. But he isn’t leaving just yet. For the next 22 months, he’ll serve as Disney’s executive chairman to help new CEO, Bob Chapek, the former head of Disney Parks, transition into the role.

Iger started his executive career with ABC in the 1980s and steadily worked his way to the top job as ABC’s chief. In the winter of 1996, Disney purchased the television network acquiring Iger in the process. In four short years, he ascended the corporate ladder to become Disney’s president and COO in 2000. Then in 2005, Iger became only the sixth CEO in the Mouse House’s history.

However, he inherited a company in trouble. His solution involved the quick expansion of Disney’s brand, which was more than any of his predecessors had accomplished. In his 15 years of leadership, Bob Iger purchased Pixar, Marvel Entertainment, LucasFilm, and 21st Century Fox; transformed Disney’s ailing animation studio; revamped Disney’s theme parks; and launched the streaming service, Disney +. Under his guidance, the Walt Disney Company became the largest media conglomerate in the world.

While many view Iger’s strategy for Disney as an evil empire monopolizing popular culture, he leaves an unmatched legacy on the corporate side of the entertainment business. He acquired existing content, reinvigorated Disney’s core business, and expanded into new markets and across new platforms. He recognized the disruptors occurring around him, and rather than sit back and observe as many conservative Disney executives did, he realized the Mouse House was perfectly placed to take advantage of them. With roughly 5.5 million American customers switching from cable to streaming companies in 2019, the combination of Disney properties with 21st Century Fox’s massive back catalog of film and television (not to mention a stake in Hulu) has made Disney a serious threat to Netflix in the streaming market.

Sure, Iger’s acquisitions have generated criticism, especially from many fans who feel Star Wars and the sequel machine at Pixar have taken a nosedive in quality under Disney. But his acquisitions have also introduced audiences to world-building on a never-before-seen scale. The phrase “cinematic universe” is now the most uttered phrase in the film industry thanks to Disney’s Marvel and Star Wars. With Marvel generating $22 billion at the box office so far, and DC and Universal hard at work on their own interconnected universes, can we honestly say this is something we didn’t want? Audiences have a voracious appetite for content, and love them or hate them, Disney has satiated that need more than any other company.

Iger’s recent book “The Ride of Lifetime: Lessons Learned from 15 Years as CEO of the Walt Disney Company”, outlines his acquisitions of Pixar, Marvel, LucasFilm, and 21st Century Fox, and gives insight into how he outwitted company Heads like Rupert Murdoch, how his friendship with Steve Jobs helped secure Marvel and LucasFilm, and more importantly, how his risky vision for Disney’s brand paid off ensuring the Mouse House dominates popular culture for decades to come.

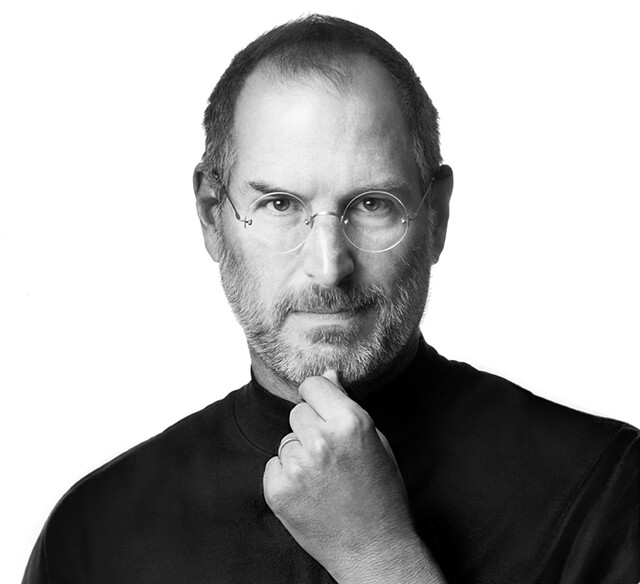

Steve Jobs became Disney’s biggest single shareholder when Bob Iger purchased Pixar. He also helped Iger purchase Marvel and LucasFilm.

Pixar And It’s Knock-On Effect on Disney Animation

When Iger took control of Disney in 2005, he had a “sense of urgency” to transform Walt Disney Animation Studios. Walt Disney had revolutionized animation, but by 2005, Disney had produced a series of flops like Treasure Planet and Home on the Range. Under Eisner, Disney had slowly moved away from animation. This was a thorny issue for Walt’s nephew and Disney board member, Roy E. Disney, which ultimately led to Eisner’s resignation as CEO.

In 2006, Iger purchased Pixar from Apple CEO Steve Jobs signaling a new era for Disney animation. Disney went from co-financing some of Pixar’s early hits to owning the animation studio lock, stock, and barrel. The acquisition of Pixar for $7.4 billion turned Disney Animation around. Iger told Jobs at the time, “Disney will be saved by Pixar and we’ll all live happily ever after.”

Jobs was happy because the deal gave him a seat on Disney’s board and made him Disney’s largest individual shareholder at the time with a 7% percent stake.

But not everyone is happy with Disney’s Pixar movies. The Atlantic argued the quality of the studio’s films has diminished, which along with the endless stream of sequels, has undermined the creative genius of Pixar’s early days. But Pixar, under Disney, also revived the Toy Story franchise and released animated blockbusters Wall-E, Up, Coco and Brave.

The purchase of Pixar also seemed to rub off on Walt Disney Animation Studios which has since produced the mega-sensation Frozen, along with Tangled, Wreck-It Ralph, and Big Hero 6.

According to Variety, the acquisition of Pixar restored the Mouse House “to the height of the Disney Renaissance — that period from 1989 to 1999 that resulted in classic cartoons such as The Little Mermaid, Beauty and the Beast, Aladdin, and The Lion King.” It returned Disney to its core business of animation.

The acquisition of Pixar is also an exemplar of Iger’s interest in people. He doesn’t just purchase a company; he acquires its talent. And he knows where to place the right people, and trust them to do their job. Disney Animation was losing morale when Iger took over. But his decision to make Pixar chief creative officer John Lasseter and president Ed Catmull in charge of Walt Disney Animation Studios turned the low morale of Disney’s animators and directors around. Pixar’s creative duo moved creative decisions from the Disney executives back into the hands of the creatives. While some of Pixar’s philosophy was transferred to Walt Disney Animation Studios, Catmull and Lasseter kept Pixar and Walt Disney Animation separate, and their different approach to production. For instance, they respected and continued Disney Animations’ tradition of using two directors for an animated feature.

In the ensuing years, Iger would also capitalize on Disney Animation’s back catalog by shepherding a number of financially successful live-action remakes of some of Disney’s animation classics. Live-action remakes of Alice in Wonderland (2010), Aladdin (2019), Beauty and the Beast (2017),The Lion King (2019) have all earned over $1 billion at the box office.

Pixar had ushered in another Renaissance for Disney, and also initiated Disney’s rise into an ever-expanding corporate juggernaut. A massive empire expansion had begun.

Bob Iger kept John Lasseter and Ed Catmull as chief creative officer and president of Pixar after the acquisition, and also made them chiefs of the ailing Disney Animation. Iger’s positioning of Lasseter and Catmull helped usher in another Disney Renaissance.

Marvel Entertainment And The Invention of the “Cinematic Universe”

Iger and his executive team drew up a list of “acquisition targets” after the Pixar purchase. Two companies were at the top of the list: Marvel Entertainment and LucasFilm. Marvel seemed like an easier acquisition than LucasFilm because George Lucas might take some convincing to relinquish control. Thus, Marvel Entertainment was Iger’s next acquisition in August 2009. To be fair, Marvel was on the radar of Iger’s predecessor, Michael Eisner. But during Eisner’s tenure, Disney’s executives thought the comic book company was “too edgy” for Disney’s family-friendly image.

“It would tarnish the Disney brand,” Iger wrote. “There was an assumption at the time – internally, and among members of the board – that Disney was a single, monolithic brand, and all of our businesses existed beneath the Disney umbrella. I sensed Michael knew better, but any negative reaction to the brand, or suggestion that it wasn’t being managed well, he took personally.”

Iger learned from Eisner’s failure, and turned to his friend and Disney’s largest individual shareholder, Steve Jobs, for assistance. Jobs put in a good word for Iger with Marvel’s Chairman and former CEO Ike Perlmutter.

“Later, after we’d closed the deal, Ike told me that he’d still had his doubts and the call from Steve made a big difference,” Iger explained. “‘He said you were true to your word,’ Ike said. ‘I was grateful that Steve was willing to do it as a friend, really, more than as the most influential member of our board.’”

Purchasing Marvel for $4 billion seems a small amount in hindsight. But even with Iron Man and The Incredible Hulk, released the year before, the film franchise wasn’t even close to being cinema’s most bankable movie series. It was a massive gamble. Sure Marvel Comics was a titan in the comic book industry, but Marvel had a history of direct-to-video B grade films featuring Nick Fury and Captain America. Now Disney wanted these characters to launch the most ambitious, inter-connected series ever devised. Ambitious in scope, The Avengers (2012) succeeded in its risky proposition of incorporating the first big-screen team-up of so many marquee characters. The bringing together of these franchises officially launched the Marvel Cinematic Universe and the concept of the cinematic universe in general. And to date, Disney has earned more than $18.2 billion in international movie ticket sales. To cap it all off, Avengers: Endgame, the final film in Disney’s ‘Infinity Saga,’ earned $2.8 billion making it the top-grossing film of all time.

While there have been many criticisms of the Marvel Cinematic Universe (most notably from director Martin Scorsese who views the MCU as the theme park approach to filmmaking), Disney’s Marvel films have taken world-building to an unprecedented level. Even though most of the credit goes to Kevin Feige’s shepherding of the whole project, the MCU would never have gotten off the ground if it wasn’t for Iger.

While Kevin Feige is responsible for the Marvel Cinematic Universe, it never would have gotten off the ground without Bob Iger.

LucasFilm: The Force Is With Iger

In 2011, Steve Jobs, who was in the last stages of cancer, convinced Bob Iger to call George Lucas and discuss a possible buyout of LucasFilm. Disney already had a foot in the door with Lucas, with Star Tours, a simulator ride at Disneyland, and Disney World dedicated to Star Wars since 1986. Even so, Iger knew he needed to approach Lucas at the right time. That moment presented itself in May 2011, with the launch of the newly revamped ride Star Tours–The Adventure Continues.

Iger set up a breakfast meeting with Lucas and asked him directly. In his memoir, Iger said the conversation went like this:

“I don’t want to be fatalistic, George, and please stop me if you would rather not have this conversation, but I think it’s worth putting this on the table. What happens down the road? You don’t have any heirs who are going to run the company for you. They may control it, but they’re not going to run it. Shouldn’t you determine who protects or carries on your legacy?”

Lucas revealed he’d been talking with Steve Jobs. And based on Disney’s handling of Pixar, Lucas had decided that the Mouse House was the only company he’d consider selling to. But letting go of his creation, especially something like Star Wars (not to mention other properties owned by LucasFilm such as Indiana Jones and Willow) was difficult. Lucas was conflicted, and Iger knew not to push. It took Lucas another seven months before he called Iger and agreed to discuss a possible sale.

At first, Lucas wanted what he called “the Pixar deal.” He believed Star Wars was worth the $7.4 billion Disney paid for Pixar. But, as Iger explained, Pixar already had guaranteed earners in development and a better infrastructure than LucasFilm.

“When we were pursuing Pixar, there were six movies already in varying stages of production, and a general sense of when they would be released. That meant they would generate revenue and profit quickly. Pixar also came with a big group of world-class engineers, seasoned directors, artists and writers, and a real production infrastructure. Lucas had many talented employees, particularly on the tech side, but no directors other than George, and no film development or production pipeline, as far as we knew.”

Disney, with Lucas’ agreement, undertook a confidential audit of LucasFilm. Lucas, sensing his Sequel trilogy might up the purchase price, resumed working on scripts. But, in the end, Lucas accepted $4.05 billion, which was considerably less than “the Pixar deal”, and just slightly more than the acquisition of Marvel.

George Lucas only ever considered selling LucasFilm to Disney after their handling of Pixar. But Bob Iger had his work cut out for him when Lucas demanded a similar price to “the Pixar Deal”.

Lucas also wanted some creative control. He didn’t just want to lose control of his legacy. Negotiations broke down twice, but, ultimately, a change in capital gains laws made Lucas sign LucasFilm over to Disney. Lucas, still worried about his legacy, hired Kathleen Kennedy as head of LucasFilm just before selling the company. Disney, based on the strength of Kennedy’s producing resume, accepted Lucas’ wish, and she has been head of LucasFilm ever since.

Disney’s Star Wars films have generated the most controversy. And there has been vocal grumbling from both Lucas and Luke Skywalker star, Mark Hamill, about the handling of the franchise. Lucas had written outlines for a Sequel Trilogy, but even his heir apparent, Kathleen Kennedy, whom he trusted to handle Star Wars according to his vision, threw out most of his ideas. In fairness, the contract between Disney and Lucas made clear that they didn’t plan on using his treatments. In a meeting, Kennedy, director J.J. Abrams, and screenwriter Michael Arndt presented their ideas for the Sequel Trilogy to an unimpressed Lucas.

“George immediately got upset as they began to describe the plot,” Iger revealed, “and it dawned on him that we weren’t using one of the stories he submitted during the negotiations.”

Iger has been relatively silent on Disney’s Star Wars films. Kennedy has been criticized by the fan base for inserting identity politics into Star Wars. Clearly, the final three films in the Skywalker saga have failed to recapture the magic of the Original Trilogy. This may be the reason for Iger’s silence, but can’t be substantiated. In ‘Ride of a Lifetime’ he makes no mention of Star Wars after The Force Awakens, despite the book covering his time at Disney right up to 2019. Marvel’s Black Panther and Avengers: Endgame, which was released in 2018 and 2019 respectively, are mentioned but there is no word on The Last Jedi or The Rise of Skywalker. Furthermore, there is a notable contrast in Iger’s appraisal of the performance of Marvel Studios’ president, Kevin Feige, and LucasFilm’s Kathleen Kennedy. Iger diplomatically comments on Kennedy’s dedication, while heaping praise on Feige for his success.

Whatever the problems at LucasFilm, Disney has more than recouped its initial $4.05 billion investment, especially with the addition of book sales, toy sales (Baby Yoda toys have been a massive hit for Disney), and the sales of other merchandise. Furthermore, some titles like Rogue One, Rebels, and The Mandalorian have generally been well-received by audiences.

Even if Star Wars’ popularity declined, LucasFilm still has a Willow TV series in development, and the next installment in the Indiana Jones series to add more revenue. Ultimately, LucasFilm was another big win for Iger and Disney. And with the Star Wars universe expanding into the previously unexplored High Republic, billions of dollars more are likely to be generated in the future.

Kathleen Kennedy has been criticized for her handling of Star Wars. But the franchise is successful nonetheless with more films and television series in the works. Bob Iger has been relatively silent about the franchise and has muted praise for LucasFilm’s boss.

21st Century Fox: Iger Outwits Murdoch And Comcast

Purchasing LucasFilm certainly had ancillary benefits for Bob Iger. He had snapped LucasFilm from right under the nose of Fox. The distribution rights to the Star Wars films, which previously belonged to 21st Century Fox, were now controlled by Disney. According to Iger, Rupert Murdoch, head of Fox’s parent company Newscorp, was furious. “Rupert was crazed that we bought Lucas,” Iger told The New York Times. “…He was disappointed in his people. [He asked them] ‘Why didn’t you think of this?'”

Then five years later, Iger made a play for 21st Century Fox itself. Both Disney and Comcast set on acquiring the iconic brand, and entered into a bidding war. But Disney and Comcast had a problem. Because Disney owns ABC, and Comcast owns NBC, and Fox owned the Fox Broadcasting Company, there was a conflict with FCC rules. The FCC prevented mergers between any two of the four major broadcast networks. This prohibited a full acquisition of Fox.

However, this didn’t stop the companies from trying to secure Fox. Deals could be made to sell pieces of Fox off and gain the coveted pieces each company wanted. Over the proceeding months, both Disney and Comcast placed exceedingly higher bids to secure Fox. On June 27, 2018, the US Department of Justice granted Disney antitrust approval as long as they sold Fox’s 22 regional sports channels. With the legalities out of the way, the deal between Disney and Fox was about to be ratified, when it suddenly fell through because Fox shareholders were unhappy with Disney’s lack of a financial forecast for Hulu.

Meanwhile, Comcast prepared to make another offer, but ultimately a series of problems and their interest in Sky made them bow out of the bidding war. The path was now clear for Disney. But Iger still had some issues to iron out. While Fox approved a deal with Disney, Iger needed regulators in countries such as China and Brazil to approve the merger. A number of conditions were set including divesting Fox Sports in Brazil and Mexico. The final hurdle for Iger was agreeing to keep the National Geographic brand from its A&E channels in Mexico.

On March 20, 2019, the merger between Disney and 21st Century Fox was officially completed.

Rupert Murdoch was furious with Bob Iger’s purchase of LucasFilm. But even he sold 21st Century Fox to Iger, which secured Disney’s dominance over popular culture.

The deal is Disney’s biggest yet. Bob Iger paid $71.3 billion in exchange for 20th Century Fox film and TV studios, and some of the movie industry’s biggest properties. Avatar, the biggest film of all time before Avengers: Endgame knocked it down to second place, is now a Disney franchise with a variety of sequels in the works. The coveted Marvel properties, X-Men and Fantastic Four, are now part of Disney and are set to be rebooted within the Marvel Cinematic Universe in the coming years.

Fox’s television catalog is also a big score for Disney. Included in the deal are channels FX, Fox Networks Group, a 73% stake in National Geographic Partners, and a 30% stake in Hulu. Fox News is not part of the deal, but The Simpsons, one of television’s biggest shows is.

Once again, Iger’s aggressive, yet congenial, nabbing of Hollywood’s biggest and hottest properties raised a few eyebrows. The acquisition of 21st Century Fox is viewed by some as nothing short of Hollywood cannibalizing itself. Quartz said the “deal would reshape Hollywood by removing major studios, reducing television and movie production capacity.” Effectively the acquisition reduced Hollywood’s six major studios to five.

But for Iger, the deal brought Marvel properties under one banner with Sony’s Spider-man shared under an exclusive deal. And the deal also gave Disney a massive catalog of film and television to launch on another one of Iger’s plans: streaming service dominance with Disney +.

To be sure, Iger’s acquisitions should reap more dividends, as Disney expands Marvel, Star Wars, and Pixar onto Disney +. It’s a brave new world in entertainment, and no one has capitalized on it more than Bob Iger.